42 ct unemployment extension 2020

American Rescue Plan Act of 2021 - Wikipedia The act makes the first $10,200 in unemployment benefits for 2020 not taxable for households with incomes below $150,000, thus avoiding the risk of many workers incurring surprise federal tax liability. $1,400 direct payments to individuals. Under pressure from Manchin, Biden agreed to have the direct payment start to phase out for high-income taxpayers, including some who … CT loses eligibility for high extended federal unemployment benefits - The CT Mirror CT loses eligibility for high extended federal unemployment benefits by Keith M. Phaneuf November 19, 2020 At least 13,000 residents are expected to lose their ability to collect extended federal...

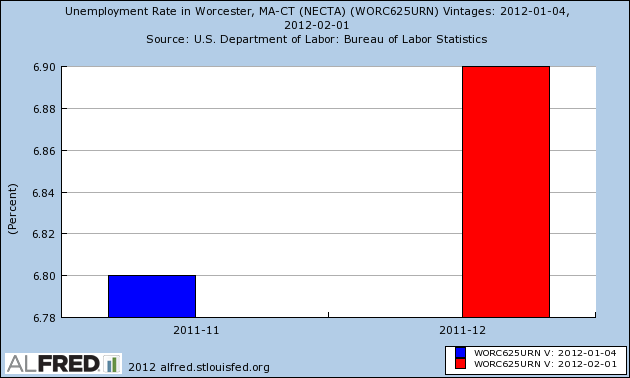

Connecticut Extends Unemployment Benefits: What You Need To Know | Across ... CONNECTICUT — The state Department of Labor has announced a seven-week extension of unemployment benefits, triggered by Connecticut's high jobless rate. Primarily federally funded, the High...

Ct unemployment extension 2020

CARES Act Extension - Unemployment - Connecticut CARES Act Extension - Unemployment. December 30, 2020. Assistance through the Emergency Coronavirus Recovery Act of 2020, also referred to as the CARES Act extension, is on the way for tens of thousands of unemployed workers at risk of losing unemployment benefits across the state. This law provides stability during a particularly volatile time ... American Rescue Plan & Federal Programs - Connecticut Extended Benefits, a 13-week extension to regular state unemployment benefits, expire when the state's three-month average unemployment rate falls below 6.5%. Approximately half of the state's close to 45,000 weekly filers are currently using Extended Benefits and will be notified that the program ends on January 8, 2022. FEDERAL PROGRAMS END portal.ct.gov › Coronavirus › PagesGovernor Lamont's Press Releases on Coronavirus Mar 07, 2020 · April 28, 2020: Governor Lamont Announces Labor Department Has Begun Issuing Supplemental $600 Stimulus Payments for State Unemployment Benefits: April 27, 2020: Governor Lamont Provides Update on Connecticut’s Coronavirus Response Efforts: April 26, 2020: Governor Lamont Provides Update on Connecticut’s Coronavirus Response Efforts

Ct unemployment extension 2020. ct unemployment extension 2020 - instict.co I opened my claim 05/29/2020 receive all 26 weeks ending 11/28/2020 receive 13 week ext peuc i telecerted the 1st & 2nd week on 12/06/2020 receive payment . Welcome to the CT Unemployment Benefits Center File a new claim for state or federal unemployment benefits Connecticut's High Unemployment Period began on August 2, 2020 and will end … To ensure that you are eligible for a federal ... ct unemployment $300 extension 2021 - sees.design Small Slider; Portfolio Types. Boh; Portfolio Standard; Portfolio Gallery; Portfolio Pinterest; Portfolio Parallax; Portfolio Simple; Portfolio Layouts. Two Col ... 2020 News Releases - ctdol.state.ct.us CTDOL Labor Situation - April 2020 CTDOL Notifying Over 75,000 Individuals Potentially Eligible For Emergency Unemployment Compensation Extension U.S. Department of Labor Offers Fraud Prevention Resources To Enhance Integrity of Unemployment Insurance Programs Lamont: Extending $600-a-week federal jobless benefit may ... - The CT Mirror The House-approved HEROES Act — endorsed by the entire Connecticut House delegation — would extend the $600 a week federal unemployment benefits until January of 2021. These benefits are currently...

Public Law 116–136 116th Congress An Act Extension of the work geographic index floor under the Medicare pro-gram. Sec. 3802. Extension of funding for quality measure endorsement, input, and selec-tion. Sec. 3803. Extension of funding outreach and assistance for low-income programs. PART II—MEDICAID PROVISIONS Sec. 3811. Extension of the Money Follows the Person rebalancing ... Ct Unemployment Extension 2021 | getpress.rest 2022 Dec 04 2020 The state unemployment fund is borrowing 75 million in order to receive 55 million from the federal government. Ct unemployment extension 2021 Reopen a previous claim for unemployment benefits. Connecticut Unemployment Extension Fileunemployment Org . Learn About Unemployment Extension Programs in Connecticut. Question: How long can i collect unemployment in ct? The official December 2020 unemployment rate for Connecticut was estimated by the BLS Local Area Unemployment Statistics program (LAUS) to be 8.0% (seasonally adjusted), lower by 0.2 percentage points from the November 2020 level of 8.2%. The Connecticut unemployment rate was 3.8% in December 2019. 99ers - Wikipedia Legislation. Legislation to extend unemployment benefits had been blocked from coming to a vote on the floor of the Senate through minority Republican filibuster or holds. . This began in February 2010 with the block of an unemployment benefit funding bill vote for already authorized and granted unemployment checks for those who had not exhausted their benefits by a single Senator, Jim Bunning (R

Letters On the Way to People Who Might Be Eligible for Unemployment Extensions ... Connecticut Department of Labor Commissioner Kurt Westby said the unemployment rate the federal government provided for Connecticut was 7.9 percent, but state officials believe the actual rate is ... Filing Extension - Connecticut If you did not file federal Form 4868, you can apply for a six-month extension to file your Connecticut income tax return provided you have good cause for your request. You can file electronically following the steps below under How to File. If you file the request by mail, follow the instruction on Form CT-1040EXT. Connecticut Unemployment Benefits and Eligibility for 2020 The Connecticut Department of Labor administers unemployment insurance benefits for workers in the state who are either partially or fully unemployed and who are either looking for new jobs, in training, or waiting to be recalled back to their jobs. The state's CT Direct Benefits is the system that is used to administer and process benefit requests. Unemployment Benefits Are IRS and State Taxable Income Enhanced 2020 unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020. However, many states ended this earlier than the September date. The unemployment benefits have increased by $300 per week as a result of the …

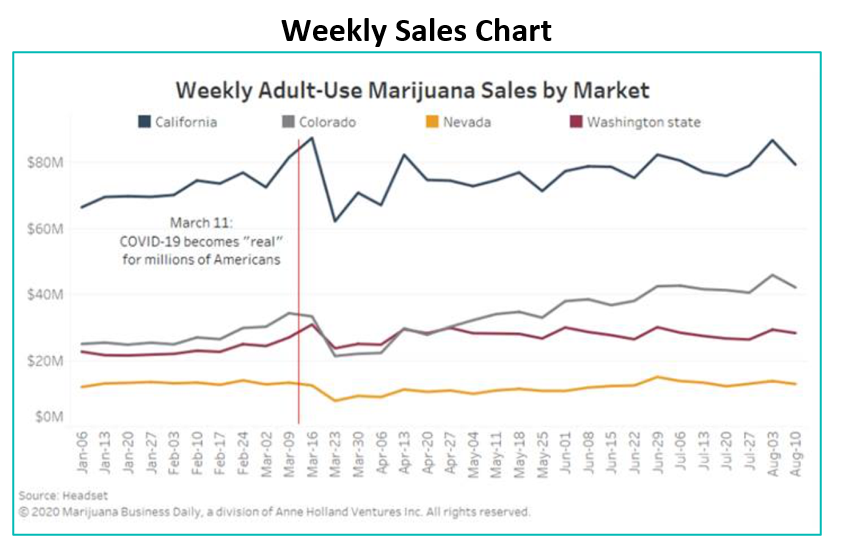

PDF July 23, 2020: Ct Dept. of Labor Update on Unemployment Applications Numbers and ... • $229K in state Extended Benefits, $3M in federal Extended Benefits; and • $2.64B in Federal Pandemic Unemployment Compensation (FPUC) - the $600 additional weekly benefit that expires July 25, 2020. The current Trust Fund balance is $102 million. To date, Connecticut DOL officials have not borrowed, but expect to soon.

IDES - Illinois Unemployment - Teleserve (312) 338... 01.11.2012 · How will this affect Illinois unemployment benefits? For weeks of unemployment beginning March 29, 2020, and ending July 31, 2020, individuals receiving unemployment benefits will receive $600 more than they would receive in their weekly benefit amount. In many cases, individuals will also be eligible for more weeks of unemployment above the 26 weeks …

Unemployment Benefits Ct Extension 2020 [2U1RM6] Search: Ct Unemployment Benefits Extension 2020. The second is Pandemic Emergency Unemployment Compensation, which extended the typical 26 weeks of state benefits by an extra 13 weeks under the CARES Act, passed in March Updated : December 17th, 2020 The $600 weekly federal supplement to unemployment benefits is set to expire July 25, while moratoriums on evictions have already expired in 20 ...

PDF Governor Lamont CARES Act II Will Provide Relief for ... - ctdol.state.ct.us UNEMPLOYED AND HELP CONNECTICUT BUSINESSES IN ECONOMIC RECOVERY (HARTFORD, CT) - Governor Ned Lamont and Connecticut Department of Labor Commissioner Kurt Westby today provided an update on the Emergency Coronavirus Recovery Act of 2020, known as the CARES Act extension. The law protects Pandemic Unemployment Assistance (PUA)

DOL Unemployment Benefits - Connecticut Connecticut Department of Labor The Connecticut Department of Labor offices will be closed Friday, April 15, 2022 for the holiday. Welcome to the CT Unemployment Benefits Center File a new claim for state or federal unemployment benefits Reopen a previous claim for unemployment benefits Create a user account for your unemployment benefits

Connecticut extends extra $300 weekly unemployment benefit to six weeks for ... Connecticut extends extra $300 weekly unemployment benefit to six weeks for workers displaced by COVID-19 - Hartford Courant Connecticut has added a sixth week of additional unemployment assistance...

› tax-forms › indianaIndiana Tax Forms 2021 - 2020 Income Tax Forms and Instructions Apr 18, 2022 · Indiana Form ES-40 is used to pay estimated taxes. If you have taxable income from self-employment, interest, dividends, unemployment compensation, and pensions, you may have to pay estimated tax to the state of Indiana. Download Indiana Form ES-40 from the list of forms in the table below on this page.

PDF Impact of Federal Unemployment Compensation Exclusion on ... - Connecticut Page 2 of 2 Effective Date: Upon issuance. Effect on Other Documents: None. For Further Information: Visit the DRS website at portal.ct.gov/DRS. Call DRS Monday through Friday, 8:30 a.m. to 4:30 p.m. at: 800-382-9463 (Connecticut calls outside the Greater Hartford calling area only); or 860-297-5962 (from anywhere). TTY, TDD, and Text Telephone users only may transmit inquiries anytime by ...

Connecticut Tax Forms and Instructions for 2021 (CT-1040) If you have taxable income from self-employment, interest, dividends, unemployment compensation, and pensions, you may have to pay estimated tax to the state of Connecticut. Download Connecticut Form CT-1040ES from the list of forms in the table below on this page. The computation worksheet and instructions for Form CT-1040ES can be found inside the PDF file. …

0 Response to "42 ct unemployment extension 2020"

Post a Comment